Unveiling the Possibility: Can Individuals Discharged From Bankruptcy Acquire Debt Cards?

Recognizing the Influence of Bankruptcy

Upon declare bankruptcy, individuals are challenged with the significant effects that penetrate numerous aspects of their economic lives. Insolvency can have a profound influence on one's credit rating, making it testing to gain access to debt or car loans in the future. This financial tarnish can linger on credit history records for several years, affecting the person's capacity to secure positive passion prices or economic chances. Furthermore, personal bankruptcy might result in the loss of properties, as specific properties may require to be liquidated to settle financial institutions. The emotional toll of personal bankruptcy ought to not be underestimated, as people might experience feelings of guilt, stress and anxiety, and embarassment as a result of their economic circumstance.

In addition, personal bankruptcy can limit job opportunity, as some companies carry out credit scores checks as part of the hiring procedure. This can present a barrier to people seeking brand-new work potential customers or job innovations. In general, the impact of personal bankruptcy prolongs past monetary restrictions, influencing various facets of a person's life.

Elements Influencing Bank Card Authorization

Adhering to bankruptcy, individuals commonly have a reduced debt rating due to the unfavorable influence of the insolvency declaring. Credit rating card companies generally look for a debt score that demonstrates the applicant's capability to manage credit history properly. By thoroughly taking into consideration these aspects and taking actions to restore credit score post-bankruptcy, individuals can improve their leads of obtaining a credit report card and working in the direction of financial recovery.

Steps to Reconstruct Credit Report After Insolvency

Restoring credit after insolvency calls for a strategic strategy focused on monetary discipline and regular financial debt monitoring. The initial step is to evaluate your credit record to make sure all financial debts consisted of in the insolvency are precisely reflected. It is vital to develop a budget that prioritizes financial obligation payment and living within your ways. One efficient strategy is to obtain a secured credit scores card, where you deposit a certain quantity as security to establish a credit rating limit. Prompt repayments on this card can demonstrate liable credit score usage to prospective lending institutions. Furthermore, consider becoming an authorized user on a relative's bank card or discovering credit-builder fundings to additional boost your credit report. It is vital to make all repayments on schedule, as settlement history substantially affects your credit rating rating. Persistence and willpower are crucial as rebuilding credit report requires time, however with commitment to seem financial methods, it is feasible to enhance your creditworthiness post-bankruptcy.

Guaranteed Vs. Unsecured Credit History Cards

Following bankruptcy, people usually consider the option between secured and unprotected credit score cards as they aim to reconstruct their creditworthiness and financial stability. Secured credit report cards need a cash money deposit that acts as security, normally equivalent to the credit limit provided. These cards are simpler to get post-bankruptcy given that the deposit decreases the danger for the provider. However, they may have greater costs and passion prices compared to unsafe cards. On the various other hand, unprotected credit score cards do not call for a down payment yet are harder to certify for after personal bankruptcy. Issuers evaluate the applicant's creditworthiness and may supply reduced costs and rate of interest rates for those with an excellent monetary standing. When making a decision between the two, people should weigh the benefits of less complicated approval with safe cards versus the possible prices, and think about unsecured cards for their long-lasting financial objectives, as they can assist restore credit score without locking up funds in a deposit. Ultimately, the choice between secured and unprotected credit rating cards need to straighten with more helpful hints the individual's economic purposes and ability to manage debt responsibly.

Resources for People Seeking Credit Report Rebuilding

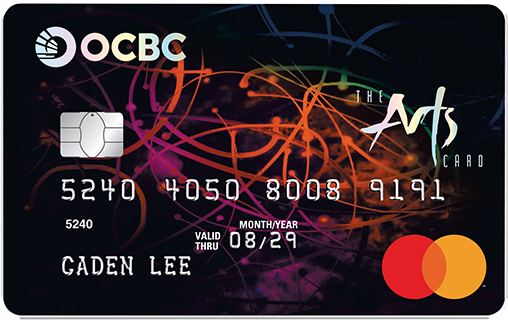

For individuals aiming to improve their creditworthiness post-bankruptcy, exploring available resources is critical to successfully navigating the credit history rebuilding process. secured credit card singapore. One beneficial source for people looking for debt restoring is credit scores counseling agencies. These companies use monetary education, budgeting help, and personalized credit scores enhancement strategies. By dealing with a credit scores counselor, people can get understandings right into their credit report records, learn approaches to increase their credit history, and obtain assistance on handling their financial resources properly.

Another practical source is credit rating surveillance services. These services enable people Homepage to keep a close eye on their credit report reports, track any adjustments or inaccuracies, and identify potential indicators of identification burglary. By monitoring their credit score frequently, individuals can proactively deal with any type of issues that might develop and make certain that their credit info depends on date and accurate.

Additionally, online devices and sources such as credit report rating simulators, budgeting apps, and monetary literacy websites can give people with beneficial details and tools to assist them in their credit reconstructing trip. secured credit card singapore. By leveraging these resources properly, people released from personal bankruptcy can take purposeful actions in the direction of boosting their credit wellness and safeguarding a better monetary future

Final Thought

In verdict, people discharged from insolvency might have the possibility to acquire bank card by taking actions to restore their credit scores. Aspects such as credit revenue, history, and debt-to-income proportion play a significant duty in credit history card approval. By comprehending the effect of insolvency, selecting in between safeguarded and unprotected bank card, and using sources for debt rebuilding, individuals can enhance their creditworthiness and possibly acquire accessibility to charge card.

By working with a credit history therapist, individuals can a knockout post obtain understandings right into their debt records, discover methods to enhance their credit rating scores, and receive support on handling their financial resources efficiently. - secured credit card singapore